RICS Home Survey (RICS Homebuyer)

Report Explained

People still refer to RICS HomeBuyer Reports but the name changed during the summer of 2021 to RICS Level 2 Home Survey. There are also Level 1 Home Surveys and level 3 Home Surveys available depending on the type of property that you're buying.

The Level 2 Home Survey is also probably the most commonly used private survey report purchased by buyers in Northern Ireland and the rest of the UK.

Who are RICS HomeBuyer Reports Aimed at?

The Level 2 Home Survey (or Homebuyer report) is aimed at anyone who is buying a "Typical" house (standard houses that aren't really old, lsted and don't need extensive renovation etc.), whether they’re planning to live in it or rent it.

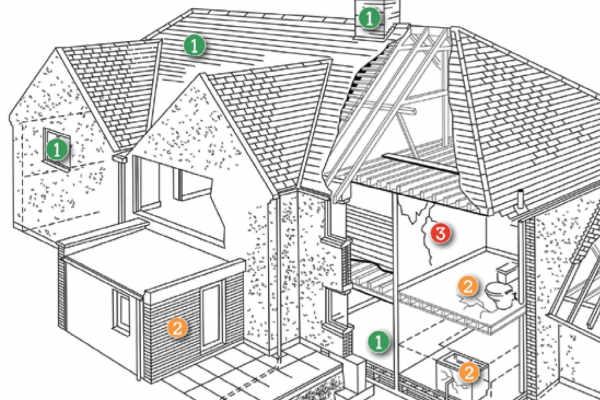

Contrary to popular belief they're not just aimed at old run down houses such as the one in this image. In fact that property would probably be better suited to a Building Survey.

What is it?

A Level 2 Home Survey (HomeBuyer survey) is an in depth inspection of a property carried out by a chartered surveyor. Typically they take between one and two hours to complete on site (depending on the size and condition of the property. The surveyor then returns to the office to write up what he/she found into the HomeBuyer Report.

The report itself can be around 50+ pages long but this will be dictated by the condition of the property and what defects were found.

The report splits the property down into sections and looks at each one individually. So, for example, there will be a section on roof coverings, a section on walls and so on. Here is an example report to see how they're laid out etc.

Within each section there may be different subsections e.g. there might be three different roof coverings and if so the one in the worst condition will be listed first and so on.

Each section also gets a number allocated to it which allows you to see at a glance which sections have serious defects '3', or require attention but are not serious '2' or need no repair '1' (see below for more details on the traffic light system).

What Types of Homes do they Suit?

Not every home will be suited to a Level 2 Home Survey (RICS HomeBuyer report), and although it’s not possible to give a definitive list of house types that will be suitable, the following offers a rough guide.

I would always advise speaking to us prior to making your decision as we’ll be able to give you some advice that should help in the decision making process.

- They’re typically suited to homes built from the Victorian period (i.e. from 1837 to present day). So the vast majority of homes in Northern Ireland.

- They are suitable for homes that are of traditional construction (such as, solid brick walls, traditional cavity and sometimes solid stone construction (depending on the surveyors experience). The house also needs to be in reasonable condition.

- Properties that may not be suitable for a Level 2 Home Survey (HomeBuyers survey) might include homes built from less common materials such as steel framed houses or properties using experimental or developing technologies.

- The report is designed specifically for the lay-person who wants to get a professional opinion at an affordable price.

- The inspection isn’t exhaustive as there are restrictions such as not moving furniture or lifting fitted floor coverings etc.

Traffic Light System:

The traffic light system was created by the RICS to make their reports simple to understand. It means you can glance at the report and see straight away which areas require immediate attention and which don’t.

- Within the system ‘3’ is for defects which the surveyor considers to be serious and/or need to be repaired, replaced or investigated urgently. So something that will compromise the structural integrity of the property and/or impairs the intended function of the building element. If these items are not repaired they would cause structural failure or serious defects. Or present a safety risk.

- ‘2’ shows defects requiring attention to repair/replacement but aren’t considered to be either serious or urgent.

- ‘1’ shows items that don’t require repair.

- ‘NI’ is for elements that were not inspected. This is used where it wasn’t possible to inspect a part of the property which would normally have been inspected.

Once the surveyor has prepared the report and allocated a rating to each element, these ratings will then be summarised at the front of the report so you will be able to see at a glance which elements require immediate attention and which do not.

The Two Types of Level 2 Surveys (RICS HomeBuyer Reports):

It’s worth noting that there are now two different types of Level 2 Home Survey report:

- Level 2 Home Survey and valuation - this one comes with a valuation element (where the report will provide a valuation and insurance valuation.

- Level 2 Home Survey without a valuation - this one does NOT contain a valuation or insurance figure and so tends to be the cheaper of the two. Some of my clients have gone for this type if they’re not getting a mortgage, or, already have a mortgage (which will already include a valuation).

Hopefully this will give you a little more information on Level 2 Home SUrveys (HomeBuyer reports).

If you would like a quote for a survey please click on the "Request a Quote" button above.

- Home Page. ›

- Types of Survey. ›

- HomeBuyer Report.